Dollar on the back foot

The market is rethinking the risk Powell cues up a taper at Jackson Hole and announces on in September. The delta variant, schools reopening and unemployment benefits running out are likely to outweigh inflationary concerns, at least in the latest rethink.

That’s put pressure on the US dollar right across the board today. The catalyst was an extremely soft US consumer sentiment survey from the University of Michigan. It crashed through the pandemic lows to the worst levels since 2011 in a move that nearly no one saw coming.

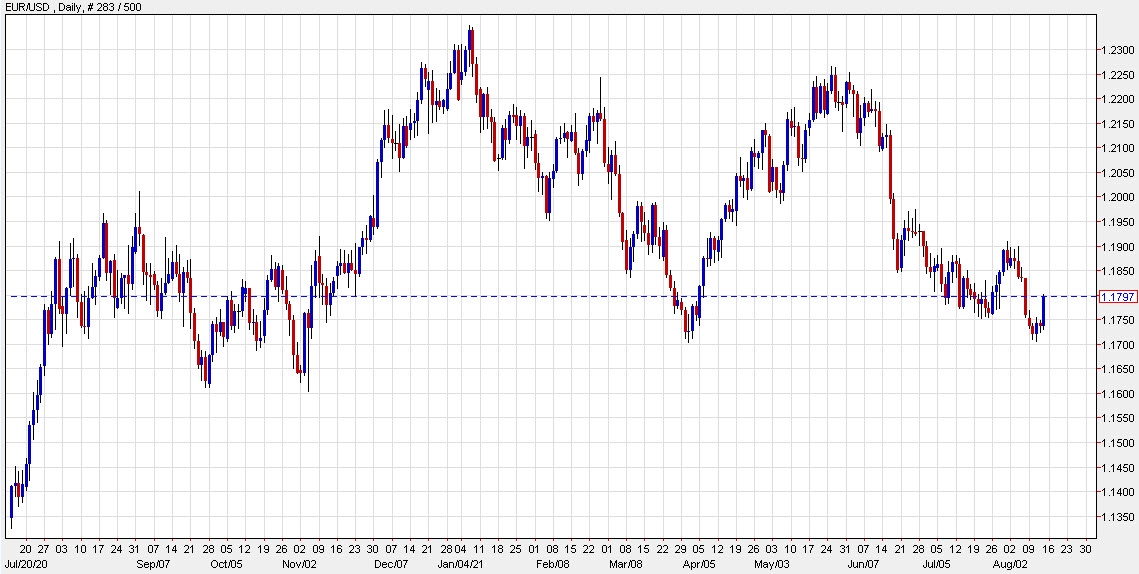

US 10-year yields are now down 5.8 bps on the day to 1.3085%. That’s spilled over into USD weakness with EUR/USD briefly breaching 1.18. It remains near the lows but the euro daily chart is an interesting one.