Open Price: 1.26112

Take Profit 1: 1.26297

Take Profit 2: 1.26514

Stop Loss: 1.25470

Trade Result: Take Profit 2 (+39 pips)

Status : Expired

Published Time: 03.53 am (New York)

We don't just talk about our performance. We prove it to you.We aim higher than just resetting the standards within the forex industry – we also deliver the highest levels of transparency to all our clients. The statistics below show exactly why we're so proud of our trading conditions, which include some of the best spreads in the business.

Open Price: 1.26112

Take Profit 1: 1.26297

Take Profit 2: 1.26514

Stop Loss: 1.25470

Trade Result: Take Profit 2 (+39 pips)

Status : Expired

Published Time: 03.53 am (New York)

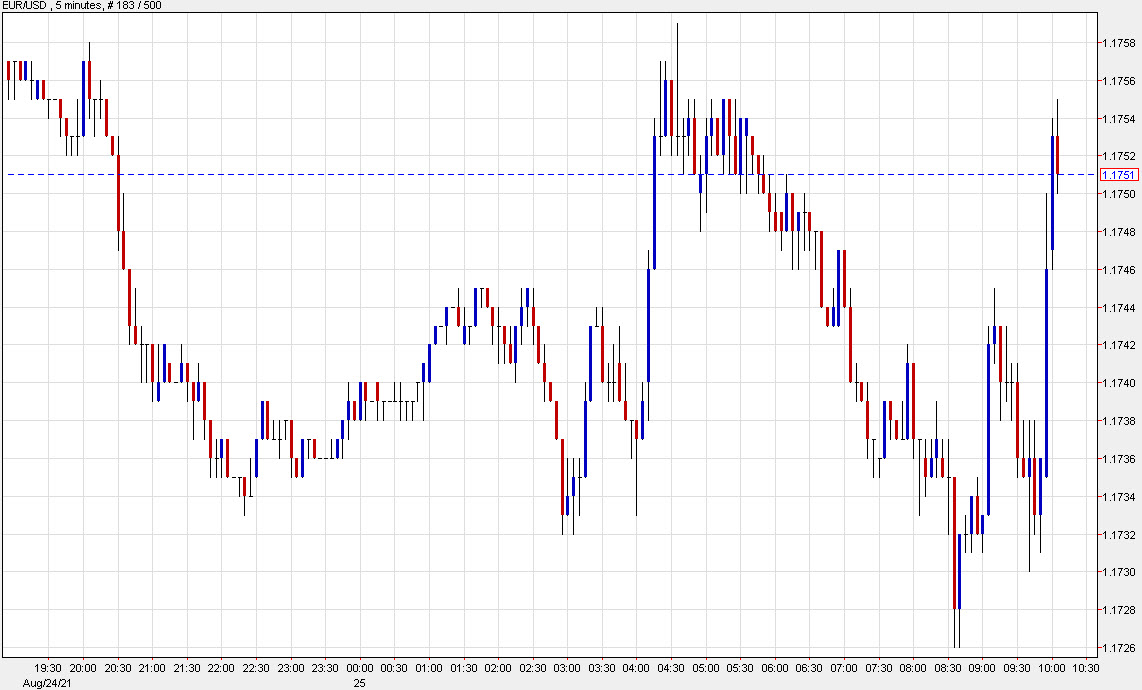

The euro and pound are back to unchanged on the day as they erase declines from the start of US trading.

Today’s trading is a bit like calling a sporting event where nothing is happening. There’s some back and forth but no one is scoring.

The latest pop in EUR/USD and GBP/USD comes after the options cut. There were some expiries and that might explain some of the flows ,particularly in a directionless market.

Whatever it was, the euro is now once-again flat on the day at 1.1749.

Open Price: 1.48190

Take Profit 1: 1.48416

Take Profit 2: 1.48729

Stop Loss: 1.47601

Trade Result: Take Profit 2

Status : Expired

Published Time: 04.52 am (New York)

Open Price: 128.888

Take Profit 1: 128.720

Take Profit 2: 128.518

Stop Loss: 129.498

Trade Result: Take Profit 1 (+18 pips)

Status : Expired

Published Time: 03.32 am (New York)

Open Price: 1.04373

Take Profit 1: 1.04548

Take Profit 2: 1.04757

Stop Loss: 1.03731

Trade Result: Take Profit 1 (+17 pips)

Status : Expired

Published Time: 03.05 am (New York)

Open Price: 0.85454

Take Profit 1: 0.85604

Take Profit 2: 0.85811

Stop Loss: 0.84892

Trade Result: Take Profit 2 (+35 pips)

Status : Expired

Published Time: 02.06 am (New York)

Open Price: 1.17120

Take Profit 1: 1.16956

Take Profit 2: 1.16744

Stop Loss: 1.17736

Trade Result: Stop Loss!

Status : Expired

Published Time: 02.48 am (New York)

Headlines:

Markets:

It was a quiet session overall as the market kept more cautious after the broader retreat in risk trades yesterday, though commodity currencies remain pressured in FX.

The loonie is leading losses as USD/CAD rose by over 100 pips at the highs, building on early gains from 1.2850 to near 1.2950 on the session; now seen near 1.2900.

The aussie and kiwi are also holding lower, with AUD/USD marked down from 0.7140 to a low of 0.7107 before keeping around 0.7120 levels now. NZD/USD moved down from 0.6840 to 0.6807 and is now trading near 0.6825.

Elsewhere, the pound is also under a bit of pressure as cable falls by 0.2% to near 1.3600.

The dollar is keeping steadier overall with little change observed against the euro and yen, even as risk tones are keeping more cautious for the most part.

European indices are down slightly alongside US futures, hinting at a more subdued end to the week although one can’t really rule out another episode of dip buyers coming to the rescue again for US equities late on in the day.

All things considered, perhaps this isn’t the taper tantrum the market was anticipating.

Open Price: 1.64019

Take Profit 1: 1.63747

Take Profit 2: 1.63524

Stop Loss: 1.64691

Trade Result: Take Profit 1/2 (+48 pips)

Status : Expired

Published Time: 05.03 (New York)

The laggards for today are the same suspects, that being the aussie, kiwi and loonie. And all three are not looking good whatsoever from a technical perspective.

The breakdown in CAD/JPY in particular points to all sorts of trouble for the loonie, especially with USD/CAD breaking the July high and looking towards 1.3000 next.

I’d argue that it is tough to see sentiment switch around on a Friday, more so with the bond market (sellers in particular) showing rather little appetite.

With yields continuing to favour a lower pull and risk mired by delta variant concerns, it is tough to find a place for commodity currencies to make a stand.

10-year yields are down slightly to 1.235%, well off the highs earlier in the week at 1.30%.

Elsewhere, US futures are also seen down 0.2% but as we have seen yesterday, dip buyers are still very much in the picture for the time being.