Open Price: 0.91628

Take Profit 1: 0.91441

Take Profit 2: 0.91258

Stop Loss: 0.92298

Trade Result: Take Profit 2 (+36 pips)

Status : Expired

Published Time: 11.33 am (New York)

We don't just talk about our performance. We prove it to you.We aim higher than just resetting the standards within the forex industry – we also deliver the highest levels of transparency to all our clients. The statistics below show exactly why we're so proud of our trading conditions, which include some of the best spreads in the business.

Open Price: 0.91628

Take Profit 1: 0.91441

Take Profit 2: 0.91258

Stop Loss: 0.92298

Trade Result: Take Profit 2 (+36 pips)

Status : Expired

Published Time: 11.33 am (New York)

Open Price: 0.71673

Take Profit 1: 0.71484

Take Profit 2: 0.71278

Stop Loss: 0.72305

Trade Result: Stop Loss!

Status : Expired

Published Time: 10.35 am (New York)

Open Price: 1.07368

Take Profit 1: 1.07216

Take Profit 2: 1.07024

Stop Loss: 1.07958

Trade Result: Take Profit 2 (+34 pips)

Status : Expired

Published Time: 01.29 am (New York)

European indices are easing a little after a steadier start to the session, down around 0.1% to 0.3% across the board. US futures have also given up slight gains, with S&P 500 futures marked lower now by 0.1% as the risk mood keeps more tepid.

10-year Treasury yields are a touch higher, up 1 bps to 1.268%, but when putting everything together, it isn’t giving major currencies and the dollar much to work with.EUR/USD is keeping afloat just above 1.1700 around 1.1720 with sellers still poised to try and test the figure level and daily support at 1.1704-11.

USD/JPY is sitting in a 18 pips range and little changed around 109.60 levels.Meanwhile, AUD/USD is holding steady at 0.7250-60 after falling to fresh lows for the year yesterday but remains in a vulnerable spot, all things considered.The kiwi is arguably the big mover on the day and while the currency is trading back lower now around 0.6910, it belies the wild moves ahead of and after the RBNZ policy decision earlier in the day. I shared some thoughts on that here.

Open Price: 0.85181

Take Profit 1: 0.85043

Take Profit 2: 0.84894

Stop Loss: 0.85690

Trade Result: Stop Loss!

Status : Expired

Published Time: 06.15 am (New York)

Open Price: 150.458

Take Profit 1: 150.604

Take Profit 2: 150.426

Stop Loss: 151.381

Trade Result: Take Profit 1 (+16 pips)

Status : Expired

Published Time: 12.36 am (New York)

Open Price: 75.747

Take Profit 1: 75.940

Take Profit 2: 76.158

Stop Loss: 75.05

Trade Result: Take Profit 1 (+19 pips)

Status : Expired

Published Time: 04.09 am (New York)

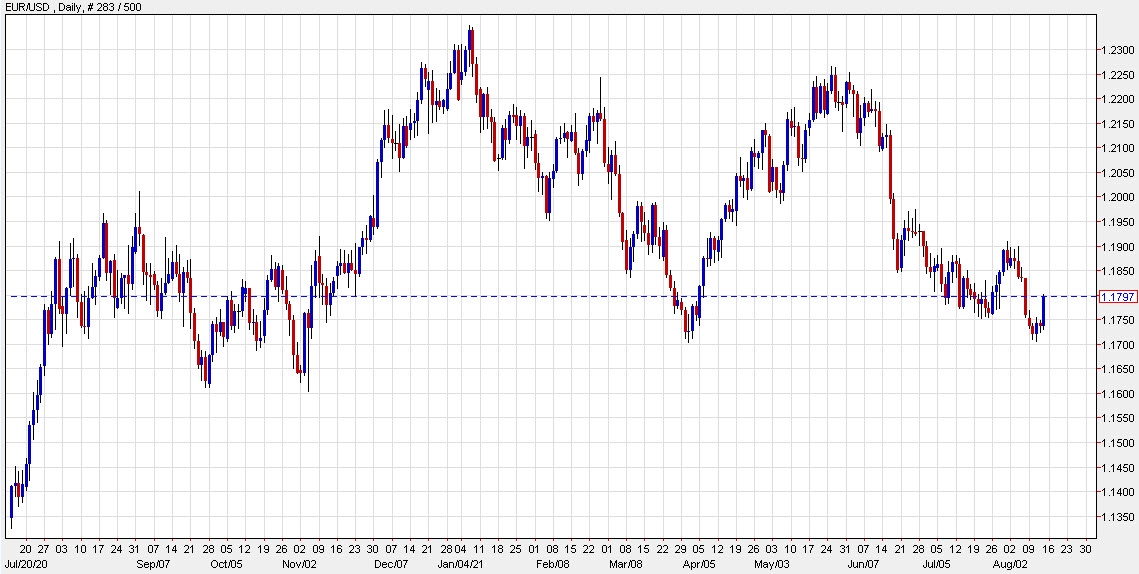

Open Price: 1.17910

Take Profit 1: 1.17763

Take Profit 2: 1.17566

Stop Loss: 1.18481

Trade Result: Take Profit 1

Status : Expired

Published Time: 12.00 am (New York)

The market is rethinking the risk Powell cues up a taper at Jackson Hole and announces on in September. The delta variant, schools reopening and unemployment benefits running out are likely to outweigh inflationary concerns, at least in the latest rethink.

That’s put pressure on the US dollar right across the board today. The catalyst was an extremely soft US consumer sentiment survey from the University of Michigan. It crashed through the pandemic lows to the worst levels since 2011 in a move that nearly no one saw coming.

US 10-year yields are now down 5.8 bps on the day to 1.3085%. That’s spilled over into USD weakness with EUR/USD briefly breaching 1.18. It remains near the lows but the euro daily chart is an interesting one.

Open Price: 129.593

Take Profit 1: 129.453

Take Profit 2: 129.250

Stop Loss: 130.087

Trade Result: Take Profit 1

Status : Active

Published Time: 01.13 am (New York)