✅ VIP Signals Instuctions :

✔️ It is highly recommended to follow this risk management strategy ✔️

————————————————————-

✔️ $100-$300=0.01 lot size (Max 3-6 trades)

✔️ $300-$500= 0.02 lot size (Max 3-6 trades)

✔️ $500-$1000=0.02-0.03 lot size per trade (Max 3-6 trades)

✔️$1000-$2000=0.04-0.06 lot size per trade (Max 4-8 trades)

✔️ $2000-$3000=0.06-0.08 lot size per trade (Max 4-8 trades)

✔️ $3000-$4000=0.08-0.10 lot size per trade (Max 4-8 trades)

✔️ $4000-$5000=0.10-0.13 lot size per trade (Max 5-10 trades)

✔️ $5000-$10000=0.14-0.24 lot size per trade (Max 6-12 trades)

🔵 How can you manage your Trades?

We offer you an options that depend on your discipline and experience. You choose:

⚠️Do not Place extra big lots.✔️✔️

If your balance is under $𝟏𝟎𝟎 then close trades at 3𝟎-3𝟓+ pips

If above $𝟑𝟎𝟎 then close half at 30+ & full at 50-60+ pips

If above $𝟓𝟎𝟎 then close half at 30+ & full at 7𝟎-8𝟎+ pips

If above $𝟏𝟎𝟎𝟎 then close half at 30+ & full at 7𝟎-8𝟎+ pips

If above $1500 close half at 30+ then you can close your trade partially

or fully when we will share our profit after every 30 pips or you can wait Untill take profit

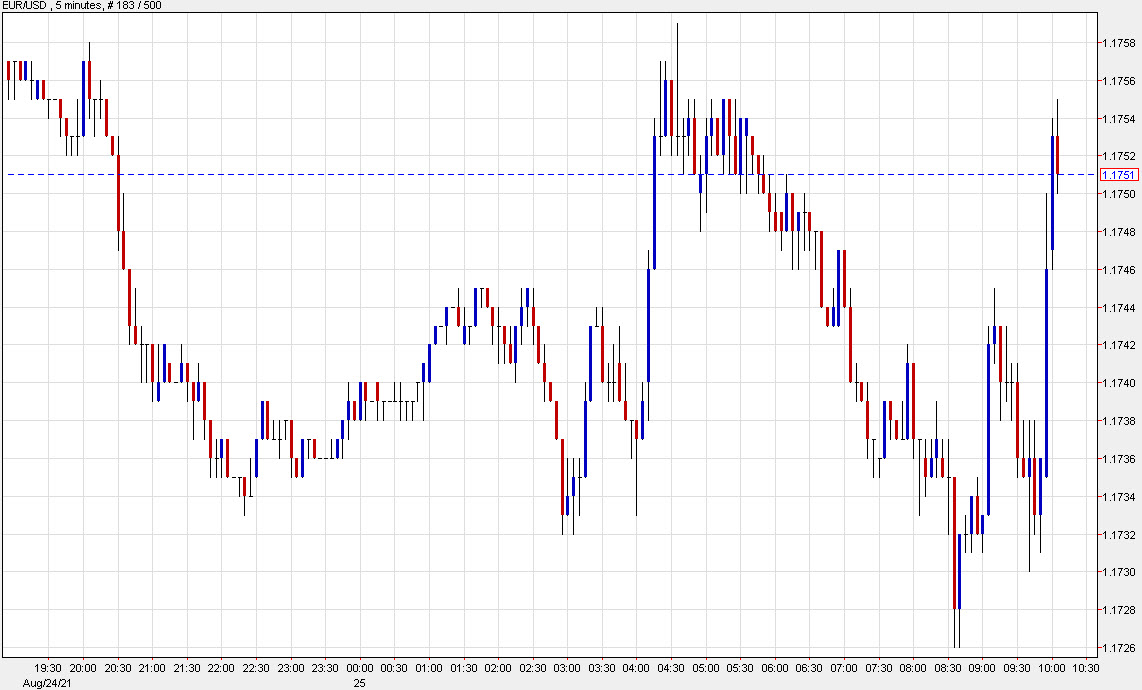

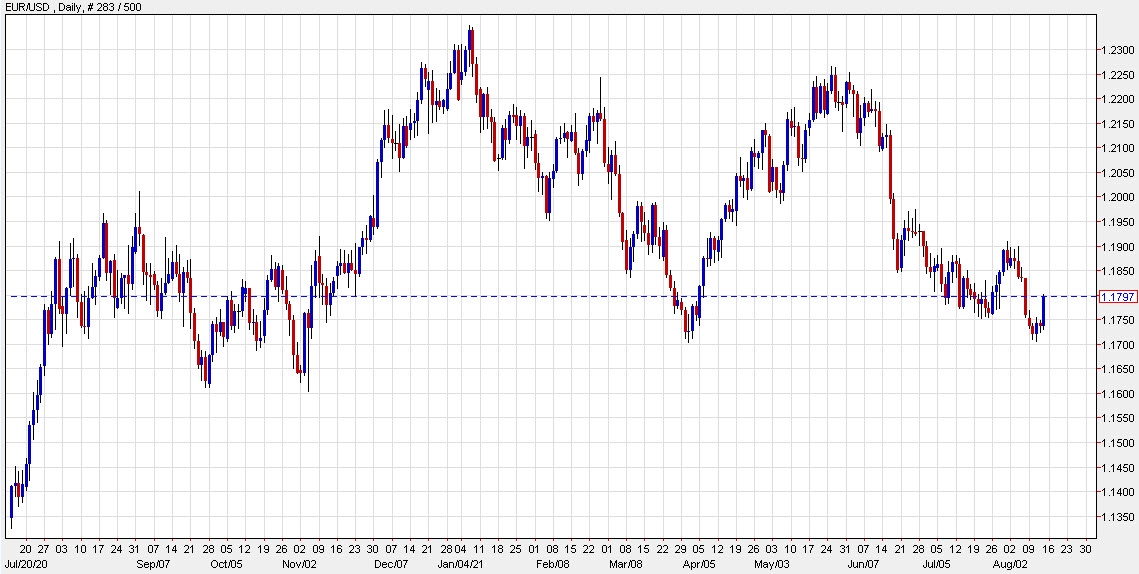

1️⃣. The strategy we trade and release our alerts is a trend following strategy and has been developed to work on H4. We use a combination of several trend-following indicators in combination with oscillators and support and resistance levels to finding the entry point, and to identify potential target areas (take profit levels) we combine areas and levels of past achievements with market price together with levels of Fibonacci expansion.

2️⃣. All trades given are instant or pending execution

3️⃣. Our signals ( Entry, Take profit and Stop loss ) does not include swap or spread, So you have to take this into consideration.

4️⃣. We give long position signal.Every signal targets 100-300 pips but not mendatory it hits the target all time.

It depends on the price movements.

5️⃣. Maximizing profit depends on your experience with the Forex market.

We provide you with the direction of the price and possible targets.

6️⃣. The implementation of the order depends on you.

7️⃣.Every kind of strategy (even the most profitable) or signal service can give you losses from time to time, and sometimes it can happen so there is a period in which several consecutive losses.

You must be emotionally prepared that a period of several loss signals may occur in the use of our signals. The market is often unpredictable and illogical and very often irrational decisions can be made from this fact.

We have some really good results and a consistent profitability that we are proud of. All you need to do to be a profitable trader is simply following our signals and having patience and persistence by not giving the cause of the bad emotion of several negative trades to affect you.

If you patiently follow our signals and adhere to strict monetary management, your hard work will surely be.

It is necessary to use our signals for a long time.

✅✅ We recommend you :

——————————————————-

✔️Before opening a new position, make a plan to enter and exit the market. Stick strictly to your plan, and do not succumb to emotions when they suggest you change it on the move.

✔️Never open positions with all your free funds. Use no more than 15-20% of them for all your open positions and no more than 5% for each individual deal. Otherwise, in the case of sudden market movements, the risk of loss is extremely high.